The final mile

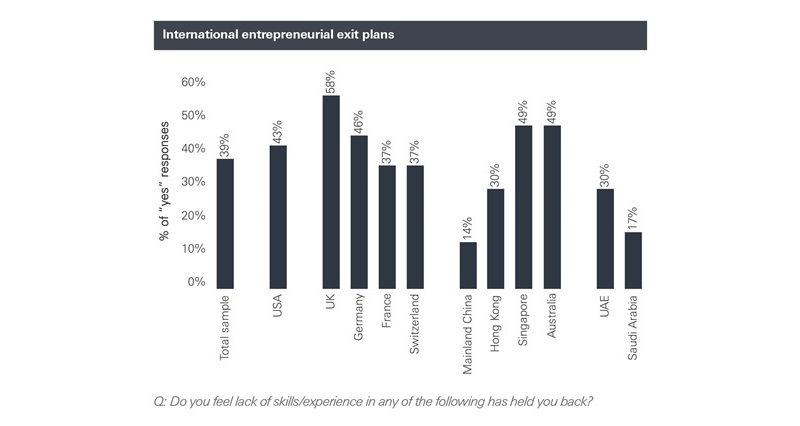

At some point on the entrepreneurial pathway – often after years of hard work – the thoughts of many entrepreneurs inevitably turn to the final destination. For many, that desired end-game will be the business exit; in fact, our research indicates that nearly two out of every five business owners (39 per cent) globally are contemplating a future sale at any given moment.

The global context

Underpinning this statistic are some notable regional differences. Across the global sample, selling is uppermost in the minds of UK entrepreneurs – 58 per cent state that this is their objective. However, the picture is more nuanced in the rest of Europe. It is commonly considered in Germany (46 per cent) yet very much a minority intention in France and Switzerland (37 per cent each).

Similar variations can be observed in Asia-Pacific and the Middle East. Exit is a popular goal in both Australia and Singapore, where nearly half of entrepreneurs say they hope to sell one day, but it is not at all a mainstream pathway in either Hong Kong (30 per cent) or Mainland China (14 per cent). In the Middle East, less than one in three entrepreneurs will choose this route.

International entrepreneurial exit plans

These results highlight that the decision whether to exit or not is, at least in part, a cultural one. Exiting a business can be seen in some cultures as a sign of success, but as a sign of failure in others.

However, entrepreneurs are also often influenced by the context in which they set up their firms.

Those who bought into a business, for example through a management buy-in or buy-out, are most likely to have considered their future exit from the business, observes Russell Prior, Head of Family Governance & Family Enterprise Succession at HSBC Private Banking.

Those who come from a family business background are more likely to think about continuity and business succession.

Meanwhile, business founders are most likely to focus their energies first and foremost on developing their original business idea. If part or all of the equity in the business is sold to a strategic funding partner, this might result in the opportunity or necessity for an exit.

“There are many reasons that prompt business owners to consider an exit,” says Mr Prior. “Strategic growth plans, business performance, family dynamics or poor health could all be factors that may prompt business owners to consider their options, which might, of course, include an exit.”

As business owners start to consider their options, it is important to have a plan. This involves preparing themselves for the sale of the business, not just preparing the business for sale, says Mr Prior. Planning should therefore be considered on two levels: the practical and the personal.

Personal motivation

Mr Prior counsels entrepreneurs to give serious consideration to their personal goals right at the start of the process.

This means really understanding their motivations and objectives. Is a sale of the business the right way forward?

This is particularly important for family businesses, where such transactions have potential implications for multiple family members including the previous and next generations (even if that generation has yet to reach adulthood).

“The personal impact of a business exit is something that entrepreneurs often miss altogether,” he says.

Their business may well have been their entire life’s work. If they are going to exit, they not only have to deal with letting go, they have to decide what they are going to do next and how they are going to manage their newly-acquired wealth.

He adds that it is often a challenge for entrepreneurs to think about themselves independently from their life as a business owner. In order to “let go”, it is therefore important that they set aside time and energy to consider the emotional impact of the sale, on them and their family.

A key part of this, says Mr Prior, is to set in motion a personal plan that considers the professional and personal opportunities that will emerge after the sale of the business. This process can help entrepreneurs maintain a sense of identity and purpose, he explains.

Practical steps

On the business side, entrepreneurs will then need to prepare for the practicalities of the sale. A common pitfall that business owners encounter at this stage is underestimating the time and e ort involved. It is a process that requires considerable stamina.

Entrepreneurs will need to be prepared to maintain their daily work routines while identifying potential buyers, going through the negotiations relating to each opportunity and finally handling the administration related to the sale. Each of these steps takes time.

“In the same way that every exit is unique, so is every buyer,” explains Mr Prior. The approach will need to be tailored for each potential buyer which takes time, commitment and a willingness to be flexible.

Entrepreneurs often have a vision for how they see their business growing in the future, but a buyer might have a completely di erent perspective.

“For the negotiations to be successful, the entrepreneur has to be prepared to accept the vision of their potential buyer,” he says. This is not always easy. If the two sides cannot achieve a meeting of minds, then there will be rejection along the path toward a final successful transaction.

His advice is to remain focused on your strategic goals and to accept that these challenges are all part of the process.

Mr Prior also counsels entrepreneurs not to underestimate the amount of focus on the business’s administration required to conclude a transaction.

On this point, his advice is to make sure the business’s administration is organised, up-to-date and ready for review before embarking on the process of identifying a future suitor.

In summary, selling a business is not something to be undertaken lightly, says Mr Prior. Anyone contemplating a transaction must first weight up the pros and cons fully taking into account the needs of the business, of themselves and their family. Failure to do so can have deeply negative consequences, which Mr Prior characterises as “sellers’ remorse”.

“We do see situations where people regret selling their business when they did,” he says “and, of course, they only realise this after the sale has taken place.”