The 3 Ps of launching an impact business – Purpose. Passion. Profit

Traditionally, the perception was that successful business models were broadly binary – attempting either to maximise commercial success or pursue social or environmental impact. Today, these notions are being upended by purpose-driven entrepreneurs, whose unique approach seeks to achieve both in equal measure.

A purpose-driven venture requires razor sharp focus and fresh ideas

To forge new paths, entrepreneurs are engaging with nascent trends and transforming existing business models. They strive to do better by pushing beyond the traditional bottom line (profits) to incorporate people, planet and profits into everything they do.

"In France, we have an encouraging regulatory framework," says Jean Moreau, co-founder of Phenix, a European food waste management company. "On one hand, the framework is punitive, which means that shops and industries pay a fine for throwing leftover food away. On the other, there is tax relief for giving the leftovers to charities. So, if companies do something productive with the leftovers, they can recuperate up to 60 per cent of the value in tax reductions. We created ourselves a niche by connecting the various players and taking commission along the way."

Historically, purpose-driven entrepreneurs were more likely to come from successful family business backgrounds, which offered valuable experience and the opportunity to more readily secure funding. This, however, is changing, as investors globally become more socially-conscious and the range of funding sources available continues to increase.

David Yeung, impact investor and founder of Green Monday in Hong Kong, launched his plant-based lifestyle platform in 2012 – well before the wellness trend entered the mainstream. His ultimate aim is to tackle big issues like climate change, public health and animal welfare by helping people make achievable everyday changes to their lifestyle. Along the way, many questioned his vision and chances of success.

"I come from a business family, so was fortunate to have some financial resources and management experience," says David. "The thing about entrepreneurship is that by the time everyone knows about 'it' – an idea, a trend, a movement – the world doesn't need you to do it anymore. Today my mission resonates, but during the early years, most questioned what I was doing."

An increasing number bootstrap their ventures with the help of social and professional networks

Although setbacks are a common feature of the entrepreneurial journey, they are rarely a deterrent. For example, those in the inception stage of their business or those with minimal funding use a range of creative tools to develop a proof of concept and jumpstart their operations.

For many, an authentic and differentiated voice, as well as an active community of followers means that even if there is not yet a product to sell, they can exponentially increase their chances of future success. To spread their message, some start by writing blogs and running events; others crowdfund, collaborate across industries or cultivate an engaging social media presence.

David uses the Green Monday platform not only to articulate the challenges we all face today and their impact, but also to offer solutions and a forum for inclusive discussion: "It started with Green Monday Foundation, which focuses on education, advocacy and awareness building, and was designed to create a common culture. This was followed by Green Monday Holdings – a platform to empower people to eat plant-based. And later OmniMeat products, to offer the same taste but nutritionally superior meat alternatives."

The COVID-19 pandemic has also accelerated the shift towards more conscious consumption and production habits, resulting in a growth spurt of nascent industries: "The reality is based on our global way of living and how quickly the ecosystem is deteriorating," says David. "As people care more about the food they eat, how the food is produced and how it lands on their plates, they become much more mindful consumers. We are seeing whole industries, like the plant-based sector, benefit."

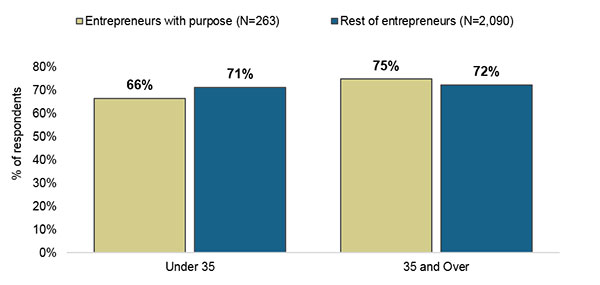

HSBC's proprietary Navigator 2020 research shows that 91 per cent of businesses believe that sustainability will be a central pillar of future growth. Research also shows that younger business owners with purpose are less likely to see limited access to capital as an obstacle to starting their venture [Figure 1]. Many are accustomed to experimenting with several different strategies and follow the 'fail fast' philosophy to decide whether an idea has value.

Q: Thinking about your goals, to what extent has limited access to investment or funding held you back?

Source: HSBC Private Banking, Essence of Enterprise

Jean's business grew from several strategic strands: "With Phenix we started with the consumer and the aim of reducing food wastage in fridges. We tested this approach, but it was too complicated and challenged by small volumes, so the economic model wasn't right. We moved on to the next idea, approaching big distributors like supermarkets about their unsold daily items and proposed options."

"Today, we start with charities; items that cannot be given to charities for logistical or legal reasons are then sold to consumers via a mobile app at reduced prices. And thirdly, we offer food to farms, animal parks and stables. These three options allow us to reach our zero-waste target."

To ensure longevity, they look for partners who perceive success differently

Most businesses require significant outside funding so finding the right partner (rather than simply an investor) whose values are aligned to theirs is essential.

David was clear about the kind of relationship he wanted from the start: "Mission alignment is paramount to us and requires vision from our partners. It's like a marriage. They must understand that this is more than a commercial business and we're trying to fulfil the triple-bottom line…I'd rather go a bit slower than make a wrong move. You don't want to end up getting divorced in 12 to 18 months."

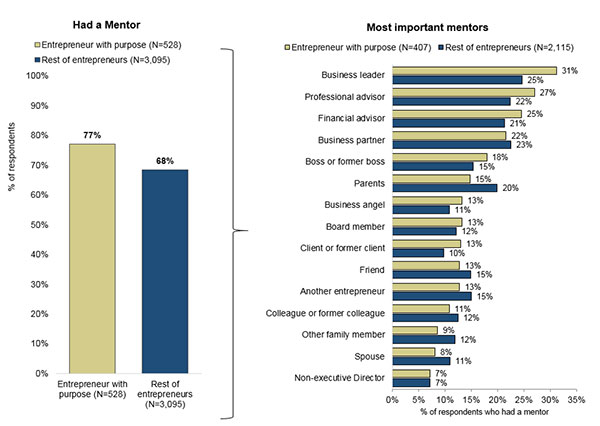

Purpose-driven entrepreneurs therefore seek input from a wider pool of experts [Figure 2]. For example, 77 per cent of purpose-driven entrepreneurs have had a mentor over the course of their career. These are typically professional connections, such as other business leaders, professionals and financial advisors.

Q: In the course of your entrepreneurial activities, have you regularly turned to specific individuals to act as a mentor to you? Which of the following individuals have been your most important mentors?

Source: HSBC Private Banking, Essence of Enterprise

A common assumption is that in business there must be winners and losers. Yet entrepreneurs creating companies with purpose show that this need not be the way. Their diverse social capital acts as the enabler of change – promoting collaboration, community and a view of success that builds on the financial bottom line and benefits a diverse set of stakeholders. Success may not be immediate, but it is sustainable.